The European Commission has formally initiated an infringement procedure against Malta, accusing the island nation of failing to provide adequate assistance in helping other EU member states recover unpaid taxes. This legal move is based on Malta’s non-compliance with Directive 2010/24, which governs mutual cooperation between member states in tax recovery processes. If Malta does not address the issue within two months, it could face further legal consequences.

Malta’s Court Procedure Under Scrutiny

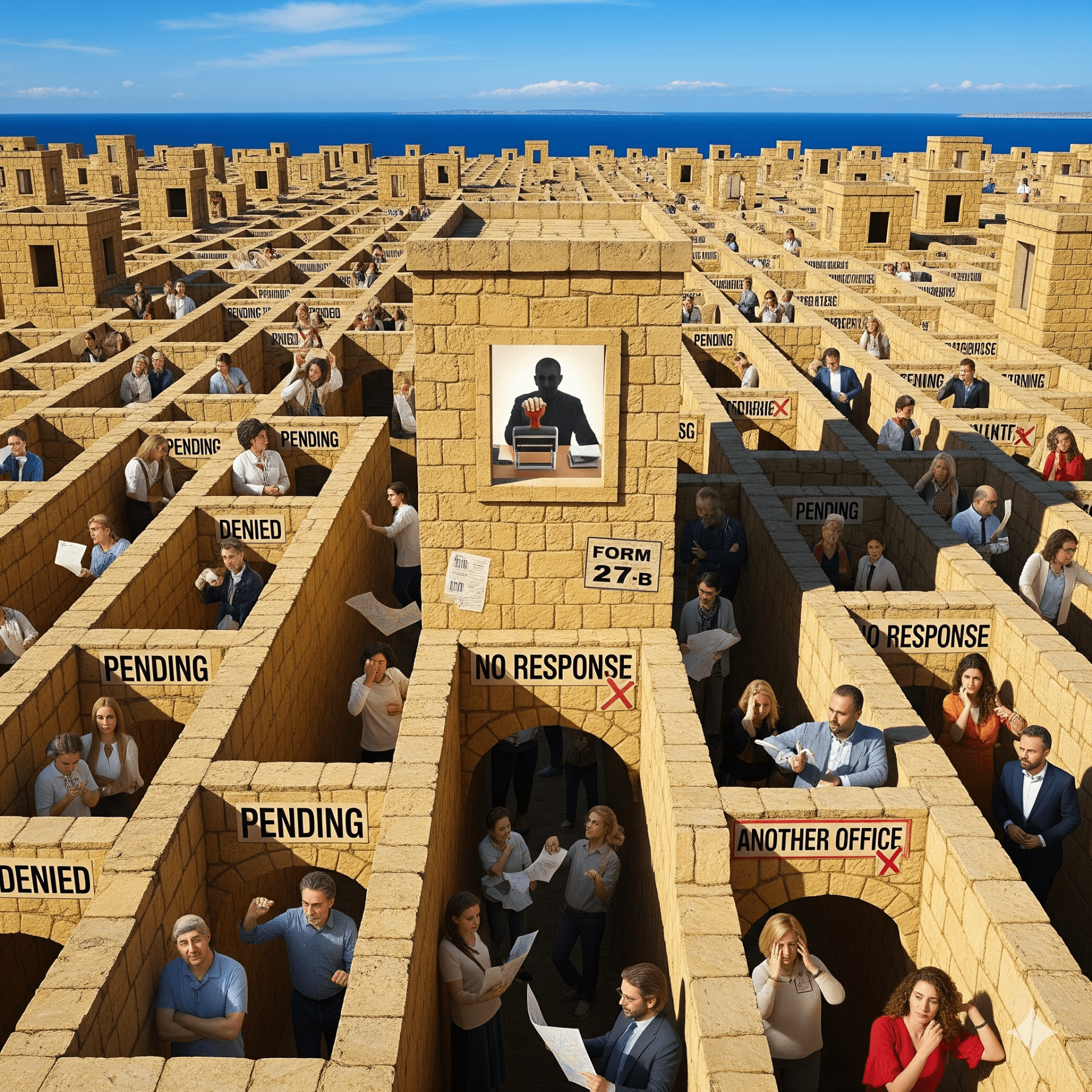

Malta’s current legal framework requires foreign countries that file tax recovery claims in Malta to seek approval from its national courts before such claims can be executed. The European Commission argues that this process is inconsistent with EU law. According to Directive 2010/24, enforcement instruments issued by one EU member state should be directly recognised by other member states without the need for further judicial review or approval.

The European Commission has expressed its concern that Malta’s legal procedure creates unnecessary barriers, slowing down the recovery of taxes owed to other member states. The directive is designed to streamline cross-border tax recovery efforts, ensuring that the European single market operates smoothly and that tax debts are efficiently recovered across borders.

Violation of EU Law

In its letter of formal notice, the Commission emphasised that Malta’s failure to apply the recovery Directive correctly not only breaches EU law but also undermines the principles of mutual cooperation between member states. The European Commission made it clear that member states are expected to assist each other without imposing additional hurdles or delays. The infringement procedure is seen as a necessary step to ensure compliance with the established EU legal framework.

Malta’s actions, the Commission argues, have created an obstacle to effective cooperation between EU nations, which is essential for maintaining the integrity of the European tax system. As the Commission noted, the Directive 2010/24 explicitly states that enforcement instruments from other EU countries do not require further validation or recognition at a national level.

Potential Consequences for Malta

Malta has now been given two months to respond to the formal notice and provide a written explanation or solution to the European Commission’s concerns. Should Malta’s response be deemed insufficient, the Commission may escalate the case by issuing a reasoned opinion, the next phase of the infringement process. If no resolution is reached at this stage, the matter could be referred to the European Court of Justice (ECJ), which holds the authority to impose penalties or other measures against member states that fail to comply with EU laws.

Growing Pressure on Malta

This latest development puts further pressure on Malta, which has been under increasing scrutiny over its tax and financial policies. Several EU nations have raised concerns about the ease with which certain companies and individuals can shield their assets in Malta, complicating efforts to recover unpaid taxes. The European Union is determined to ensure that all member states, including Malta, uphold their obligations under EU tax cooperation rules.

The infringement procedure is just one of many tools the European Commission has at its disposal to ensure that member states adhere to EU law. If Malta fails to comply, it could face significant legal and financial consequences, including fines or the suspension of certain EU benefits.

A Test for EU Solidarity

This dispute highlights the challenges the European Union faces in ensuring solidarity and cooperation among its member states, particularly on sensitive issues like taxation. The ability of the European Commission to enforce compliance is crucial to maintaining the integrity of the EU’s legal and economic framework. The outcome of this case could have broader implications for how member states approach tax recovery and cross-border cooperation in the future.